BRIDGE PAYMENTS ONLINE PATIENT PAYMENT PORTAL

Making healthcare payments a breeze.

Safe and secure patient payment solutions, trusted by thousands of healthcare practices for more than 30 years.

ONLINE PATIENT PAYMENT SOFTWARE

Shift away from outdated methods of patient billing and payment collection.

Bridge Payments is an easy-to-use PCI compliant system, developed specifically for healthcare practices to grow and thrive. By optimizing and automating payment capture at all points of the patient journey, practices become more efficient and unlock new profitability potential.

IMPROVE OPERATIONAL EFFICIENCY AND PRODUCTIVITY

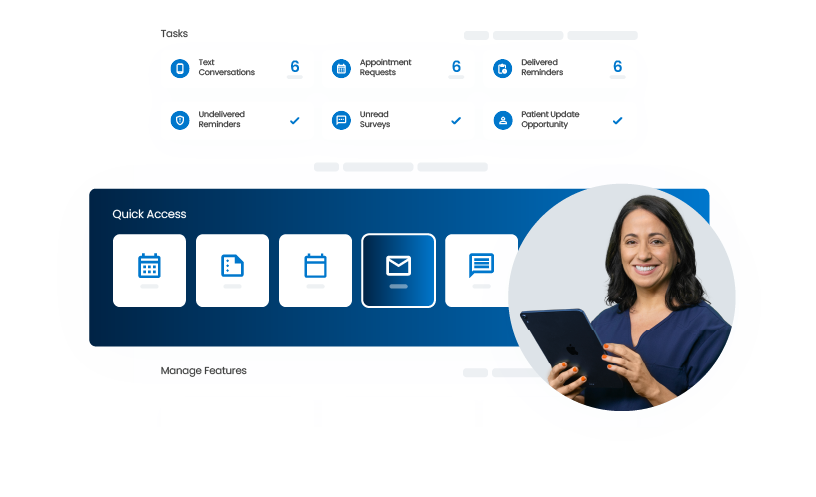

Unlock operational and administrative efficiency.

There is an answer to reduce time-consuming day-to-day administrative tasks that are exacerbated when staff is low, or short-handed. Payments automation supports practices and organizations that strive for more time to connect with patients, increased revenue, and improved cash flow, with fewer tedious tasks and distractions.

Benefit from:

Automatically post payments to the patient ledger.

A simple interface that automatically works with any existing practice management system or electronic health record.

Hundreds of integrations that make payments management even easier without the need to toggle between multiple screens.

GET PAID FASTER

Lower accounts receivable and increase revenue.

Practice revenue cycle management relies heavily on patient out-of-pocket payments so it’s imperative that payment and medical financing options are offered at multiple points along the patient journey. When making payments is an expected and easy part of the process, providers spend less time tracking down unpaid bills. Communicate payment options digitally, even before treatment occurs and empower patients to pay balances online from virtually anywhere.

How you benefit:

Cut time spent collecting and posting payments.

Empower patients to pay on time by offering convenient options like online payments, text-to-pay, and QR codes.

Cut costs associated with paper bills

Offer payment over time and patient financing options at no financial risk to your practice.

PATIENT FINANCING AND PAYMENT PLANS

Empower more patients to say “yes” to treatment.

Healthcare costs are on the rise, causing patients to make tough decisions- including declining or deferring care. Our recurring payment plans and patient financing options help providers ease financial barriers and offer friendly ways to make treatment more affordable and accessible. Patients and providers work together on a payment amount and schedule that makes sense, and nearly 100% of patients qualify for a financing option, regardless of their credit score.

Benefit from:

Flexible financing options attract more patients to your practice and enable them to be more consistent with their payments.

Ease difficult conversations about cost of care by presenting payment options that make sense.

Our non-recourse healthcare financing solutions ensure you get paid for the care you render, sooner and reliably.

Top payments and financing features

Patient Financing

High approval rates for nearly all patients

Contactless Payments

Convenient, modern in-office options to simplify the payment process

Text-to-Pay

Reduce paper statements

Payment Plans

Let patients pay over time

Automatic Posting

Eliminate payment data entry

Online Bill Pay

Online Bill Pay

Tap, pay, and go.

Offering Apple Pay®, Samsung Pay, and Google Pay™ for convenient mobile payments and tap-to-pay transactions.

Convenient, user-friendly, and contactless interactions with their providers will elicit confidence when [patients] enter the clinic.”

G. David Adamson, M.D. CEO and Founder of ARC® Fertility

We are excited to partner with Rectangle Health to bring solutions to our practices that bring workflow efficiencies and provide patients more ways to pay.”

David Lane Vice President of Saisystems

0

%

Decrease in time spent collecting and posting payments.

0

%

Reduction in time spent on payment reconciliation.

0

%

Reduction in time spent processing manual refunds.

Serving thousands of healthcare providers for over 30 years.

We went from nearly zero credit cards on file to about 12% across our portfolio in about four months. It really has been a monumental movement forward in a pretty short period of time. And we’re now approaching 30%.”

Donna Ramadan Vice President of Revenue Cycle and Compliance at Great Lakes Dental Partners